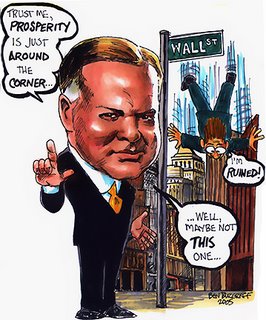

Congress is about to buy up $700 billion worth of risky loans in a desperate attempt to avert financial disaster, but it may be too late. Things are bad and are quickly getting worse. This paragraph from today's developing story in the

Wall Street Journal is particularly shocking

:Last week, as deep new fissures opened in global financial markets, the U.S. Treasury unveiled a plan to spend up to $700 billion to buy soured mortgages and mortgage-related securities from financial institutions. In many respects, the financial sector last week all but ceased to function.

Consider that last phrase: the financial sector had "all but ceased to function."

Another item, again from the

WSJ:

The Federal Reserve agreed to convert Morgan Stanley and Goldman Sachs into traditional bank holding companies. With the move, Wall Street as it has long been known will cease to exist.

No more investment banks. Morgan Stanley and Goldman Sachs will be holding companies, buying up troubled banks and shielding them from the type of nervous investors who toppled Lehman Brothers, Bear Stearns, and Merrill Lynch.

The financial sector has ceased to function. Wall Street, in any known form, will cease to exist.

And consider how much $700

billion really is. That's $2,295 in additional debt for every man, woman, and child in the United States. And this is to rescue the financial institutions, not to help the taxpayers who are responsible for paying the bill. This is the socialization of debt on a grand scale. If you are Fanny Mae or Freddy Mac, or AIG or Lehman, your losses are covered by the taxpayers. We have, in effect, nationalized the mortgage industry.

Now, of course, if you are a taxpayer in trouble, don't expect a dime's worth of help from the government. If I fail to make my mortgage payments, the bank will take my house. Nobody in Washington is concerned if my retirement fund loses money (and, in fact, it has). And I'm lucky. What about people who are homeless? What about people without retirement accounts? And what, for God's sake, about the number of people (and many of them working hard for a living) who have no health insurance?

Another

WSJ story leads with:

With as few as 72 hours before Congress votes on a federal financial-markets rescue, the financial industry has launched a ferocious effort to shape key provisions, in a fight that could yet stall the bill. Lobbyists and financial-services executives are working deep connections within the administration to ensure as many institutions as possible benefit from a $700 billion federal mechanism to buy distressed assets, then sell them off in better times. In a particularly controversial move, they also oppose proposals by Democrats in Congress to provide mortgage reductions for homeowners facing bankruptcy.This is outrageous.

The presidential candidates and sitting politicians will rush this week to create a "Newer Deal" promised to stave off financial disaster. Only, they won't be able to do it. This financial collapse is global, and to try to stop it will be like trying to stop a tsunami. And the politicians of both parties have taken lobby money for so long from the very people that have created this nightmare that their knee-jerk reaction will be to protect those familiar monied interests instead of who they really are supposed to work for, the people.

How about socializing health care instead of corporate profits? How about investing in jobs programs instead of passing laws which give the credit card companies more profit and less regulation? How about making sure that all the children in this country have enough to eat instead of letting the CEOs of these negligent corporations bail out with their golden parachutes intact?

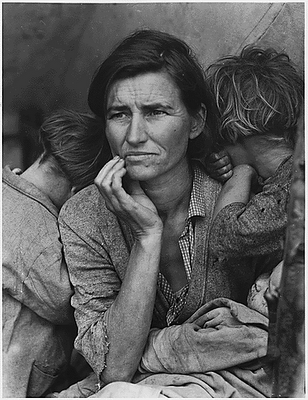

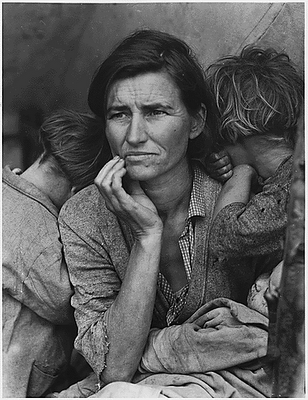

We're not supposed to mention the D word -- Depression -- for fear of creating a panic. After all, things can't be that bad. But take a look at the photo above. It is, of course,

Migrant Mother, the famous 1936 photo taken by FSA photographer Dorothea Lange. This is what's at stake. Don't panic, but don't go shopping, either.

Had a telephone interview this morning with Paul Simpson, who is writing a piece on my Indy novels for the official Indiana Jones magazine. He's a nice chap (he and the magazine reside in England) and he did me the courtesy not only of reading the Indy books, but also my most recent novel, I, QUANTRILL.

Had a telephone interview this morning with Paul Simpson, who is writing a piece on my Indy novels for the official Indiana Jones magazine. He's a nice chap (he and the magazine reside in England) and he did me the courtesy not only of reading the Indy books, but also my most recent novel, I, QUANTRILL.